Thinking of moving on from your vacation ownership? If so, there’s probably one question you’ve asked yourself by now: “What is my timeshare worth?” It’s an important question, and one we can help you answer. We’ll go over how to determine your ownership’s timeshare value, what you can do once you know it, and offer some tips for navigating the resale market.

Do Timeshares Retain Their Value?

Before we begin, it’s important to note that not many timeshares retain their “value” over the years. Being aware that timeshares rarely appreciate in value can be a helpful asset when you’re looking to sell your ownership. Some may wonder why people buy timeshares if they’re not worth much later on, but the true purpose of timeshare was never to be an investment. The real value comes out of their use. Timeshares guarantee owners to go on vacation every single year and save money compared to hotel stays. Not to mention, the product is meant to last an entire lifetime and can even be passed down to children or grandchildren. It’s better to think of a timeshare property the way you would a car. After all, cars depreciate in value as soon as you drive them off the lot. Yet they still have a lot to offer.

The timeshare resale market is relatively new, and some families don’t use their timeshare like they thought they would. A shift in lifestyle could cause timeshare owners to sell. Or they could simply want to switch to a different vacation club. Either way, keep your expectations low when starting this process if you’re trying to say goodbye to timeshare maintenance fees and dues. Selling your timeshare or contacting your resort developer is the best way to find relief safely.

Why Are Timeshare Resale Values So Much Lower?

So why do timeshares usually fetch such a low price on the resale market? The answer is simpler than you might think. While maintenance fees help keep resorts sparkling and well cared for, they don’t boost your unit’s sale price later on. What you’re really purchasing is the right to use a vacation spot every year, not a slice of appreciating property. When it comes time to sell, there’s simply less demand—new buyers have a wide selection and little urgency since timeshares are plentiful. There are also club benefit restrictions placed on resales, making pre-owned options less enticing for owners wanting all the bells and whistles. All of this adds up to a resale market where prices generally stay low, and expectations should stay realistic.

What Are DVC Timeshare Points Worth?

There is, however, one exception to the rule that timeshares don’t appreciate in value: Disney Vacation Club. DVC points aren’t cheap, but they can retain, or in some cases appreciate, in value. Again, buying Disney Vacation Club points should not be considered an investment, so you shouldn’t expect to profit from your purchase. There are variations in timeshare resale values among the DVC timeshare resorts. For example, a 200-point package at Aulani sells for much more than 200 points at Hilton Head. This is mostly due to popularity and resort demand, so even within DVC, not every point has equal timeshare worth.

While you may not profit from selling your DVC points, it’s good to know that after many years of magical vacations, you may recover a large portion of your purchase price. As an example, if you purchased Old Key West DVC points at the original price per point back in 1991 at $62.75, you could sell them on the resale market in 2025 for an average of $76.43 per point!

Someone Called Claiming They Have a Buyer for My Timeshare

If you aren’t looking to sell your timeshare and you get an “out of the blue” phone call from someone claiming they have a buyer ready who will pay more (or even thousands more) than what you originally paid, take caution. First and foremost, a legitimate resale company will never call you unsolicited. If you haven’t posted your timeshare for sale, it would be rare for an unexpected buyer to contact you. This is one of the most common timeshare resale scams to avoid!

Additionally, as we’ve mentioned before, timeshares rarely sell for more than you originally paid for them on the resale market. There are buyers out there who look to the resale market to add points to their ownership or get a great deal. However, most of them aren’t going to pay the full price due to certain brands’ resale restrictions. You’ll know an offer is a scam if the “agent” also asks for a steep upfront fee or a wire. This should sound suspicious to you. After all, you’re the seller! You should never have to pay steep upfront fees to sell your ownership. If something sounds too good to be true, it probably is. Unfortunately, scams like this have given people the wrong impression that timeshare is a scam. Fortunately, there are ways to stay safe while navigating the resale market.

What Factors Affect the Resale Value of a Timeshare Worth?

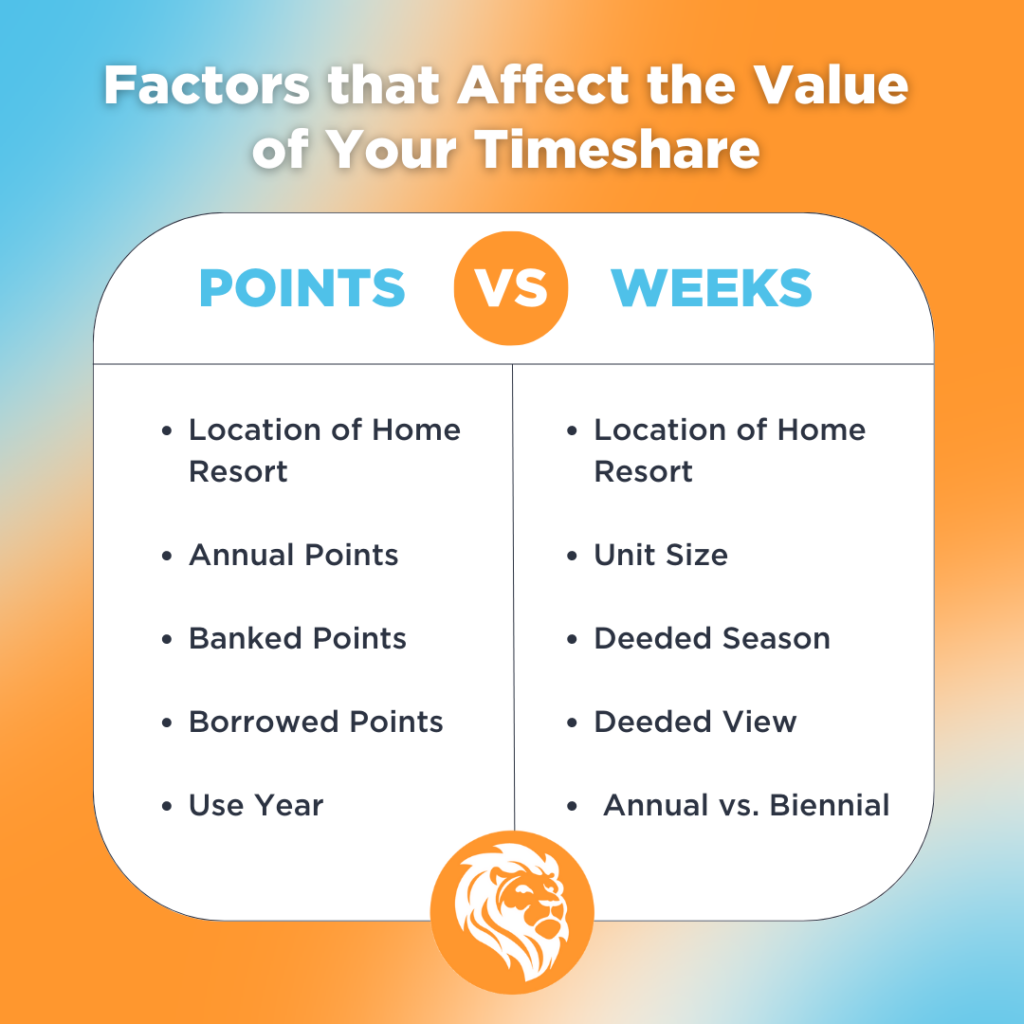

Determining resale prices can be influenced by many factors. One of the main things that affects resale prices is the resort location. For example, if your resort is in a top location like Orlando, Hawaii, or Breckenridge, your timeshare’s worth might be higher because more people want to vacation in these locations. Additionally, the size of the brand in question can also affect a timeshare’s value. Compared to smaller independent resorts, resorts owned by popular brands, such as Hilton Grand Vacations or Marriott Vacation Club, are in greater demand. In other words, the best vacation clubs tend to come with the highest prices.

Another factor to keep in mind is your ownership type. Timeshare points are the most popular ownership type because they can be used more freely and have no set dates or locations. For fixed weeks that stay in the same property each year, size can affect the price. For example, a standard-size villa selling rate will be less than a three-bedroom suite. Point-based timeshares are similar. The more points you have, the more money you will get for your ownership. Lastly, the time of year that your timeshare is available matters. Popular travel seasons tend to be pricier compared to those that are quieter. So, summer and winter getaways tend to have pretty high values. Of course, how you decide to price your timeshare is ultimately up to you, but keeping these factors in mind is a great way to assess the value of your ownership.

Demand for Peak Seasons and Fixed Weeks

For many timeshare owners, points-based timeshare ownership offers helpful flexibility in bookings and locations. However, that same flexibility can sometimes make it harder to snag reservations during busy times—especially in high-demand destinations and peak seasons, like major holidays or summer break. For example, booking in places like Park City during Christmas can be highly competitive.

Because of this, fixed weeks in premier locations and during high-demand periods are especially attractive on the resale market. If you own a Christmas week at Marriott Vacation Club’s Aruba Surf Club or a highly coveted week at Hilton Grand Vacations’ West 57th Street in New York, you may be pleasantly surprised by what buyers are willing to offer. These fixed weeks often command higher prices simply because the demand for guaranteed holiday stays in desirable spots is so strong.

So, while points-based systems have their perks, don’t underestimate the value of a prime fixed week in a sought-after location—especially if your ownership aligns with popular vacation times. This added layer of desirability could mean a higher resale value for your timeshare.

Comparing Your Timeshare to Others on the Market

If you’re unsure about how to price your timeshare on the resale market, a smart move is to check comparable listings that have recently sold. Think of it as an “apples to apples” comparison:

- If you own a fixed week, try to find prices for the same week or a similar season at the same resort.

- For owners of points (like those with Marriott Vacation Club, Hilton Grand Vacations, or Disney Vacation Club), compare with others from the same brand, since resale value can vary significantly between companies.

- Even small details—like view type, room size, or specific amenities—can influence what buyers are willing to pay.

Looking at these comparable resales can give you a realistic sense of what buyers are actually paying—not just what sellers are asking.

Don’t Forget About Maintenance Fees When Pricing

An often-overlooked factor when setting your resale price is those annual maintenance fees. Put yourself in the shoes of a potential buyer—they’re not just considering the upfront cost, but also the recurring expense that comes with ownership. For brands like Disney Vacation Club, Hilton Grand Vacations, or Marriott Vacation Club, these ongoing fees can vary widely and impact just how attractive your listing is compared to similar options.

If your maintenance fees are higher than average for your location, season, or resort, you might need to adjust your asking price to stay competitive with other listings. Keep in mind, buyers are usually looking for a great deal and are well aware of these long-term costs. Plus, the longer your timeshare sits unsold, the more years you’re responsible for paying these fees yourself. Being realistic—especially if your goal is to sell quickly—can make all the difference in finding the right buyer.

Find Out What Your Timeshare Is Worth and Get a Fair Market Value

Knowing that you may not always get back what you paid for it, pricing your timeshare competitively is very important on the resale market. You want to get a fair market value. When you work with one of our agents at Fidelity, you’ll receive expert advice and help to create a listing that competitively prices your ownership.

If you really want out, consider pricing to sell quickly. Sometimes, a lower asking price can help your listing stand out from others and attract serious buyers faster—especially if you’re motivated to move on from your ownership. Remember, the resale market is different from when you first purchased; patience is valuable, but flexibility on price can make all the difference if your main goal is a quick sale.

Our Licensed Real Estate Agents can estimate your timeshare’s worth, so you know what to ask for. It’s important to find the value of your timeshare before you sell it! An agent will be able to provide prices of similar timeshares for sale and even ones at your home resort. This is a great way to figure out what your timeshare could be worth. If you want to change your selling price, we can adjust accordingly. Fidelity can also help facilitate negotiations with potential buyers.

Sell Your Timeshare on the Resale Market

Once our agents help you find out what your timeshare is worth, it’s time to sell! Fidelity Real Estate has been in the timeshare resale industry for over 20 years. We have an A+ rating as an Accredited Business with the BBB and are a featured reseller for the ARDA Coalition for Responsible Exit. As a result, we have the reputation and skills necessary to help you sell your timeshare ownership. So, if you’re ready to say goodbye to maintenance fees, fill out the form below, and one of our agents will reach out about the next steps. Still have questions? No problem! Email us at [email protected] or call us at 1-800-410-8326, and we’ll be happy to assist you.